Hi there, my name is Cassandra. I live on the west coast/best coast and this is going to be a place to share my money decisions and journey.

High level view:

DINK

0 debt, credit score about 750

College-educated

Healthcare w2, 40hpw. 4.5 weeks PTO a year, one time bonus yearly.

H(ish)COL

I’m partnered with someone who makes double what I do but I pay 50% of rent, 50% of utilities, my own phone bill, my car insurance, my gas, car repairs, 50% of groceries. He pays for our dates (dinners, drinks) and some travel expenses like if we book a tour, but I buy my own flights and about 25-50% of the lodging…because he’s more picky and chooses nicer places. I buy our concert tickets and special events. My parents occasionally help me out with a random $50-100 especially if I have an unexpected expense. For the most part, I’d say I’m self-funded but I couldn’t live where I live by myself (the rent is over half my income but splitting it is about 25-35% and very doable). What is in my accounts I earned through my w2 and side hustles.

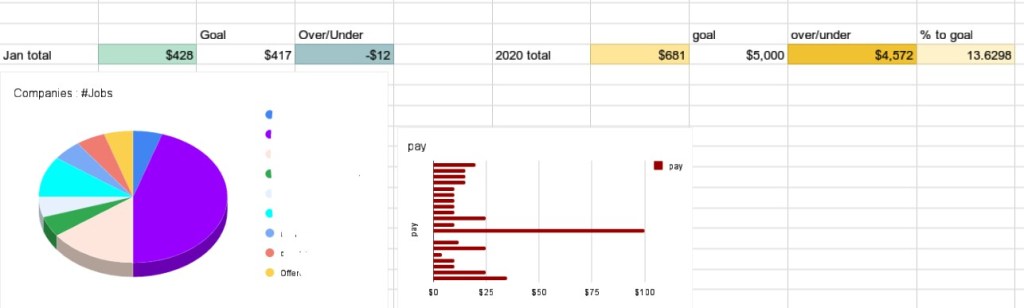

2020 I changed my 401k withholding to 18% from pretty much a lifelong 5-7%. My goal is to earn $5,000 in a self-directed portfolio (I use Robinhood) by the end of the year, from my various hustles.

2019 is also the year I broke 100k net worth. I hope to retire at 55 but it’s dicey now because I make so little. One can only hack and hustle so much before it’s simply evident one needs a higher income. My partner and I have spoke about house hacking (buy a duplex or triplex and rent the other unit[s] to pay our own mortgage) but we don’t plan to stay in this HCOL area.

To earn an extra $5,000 this year, I need an extra $416.66/mo. Since I just surpassed $425, I figured I’m *really doin’ this, Har’!* (Dumb and Dumber) & could document the process. You’ll be able to see what works on a lowish income and you’ll learn what I’ve tried and didn’t work for me (Postmates, among others).

Last thing, I’m in a no-buy low-buy month/quarter/year. I have too much crap. I will not buy makeup, skincare, hair care, misc beauty, candles, housewares, clothing, shoes or perfume unless I use something up or truly need it. I may share my monthly trash pile of what I’ve used up. I’m not zero waste but I have moved away from a lot of disposables and plastic for environmental reasons. I do eat meat and drink moderately. This is me. I’m not a financial advisor.